How hotels make ROI in the MICE sector measurable and profitable

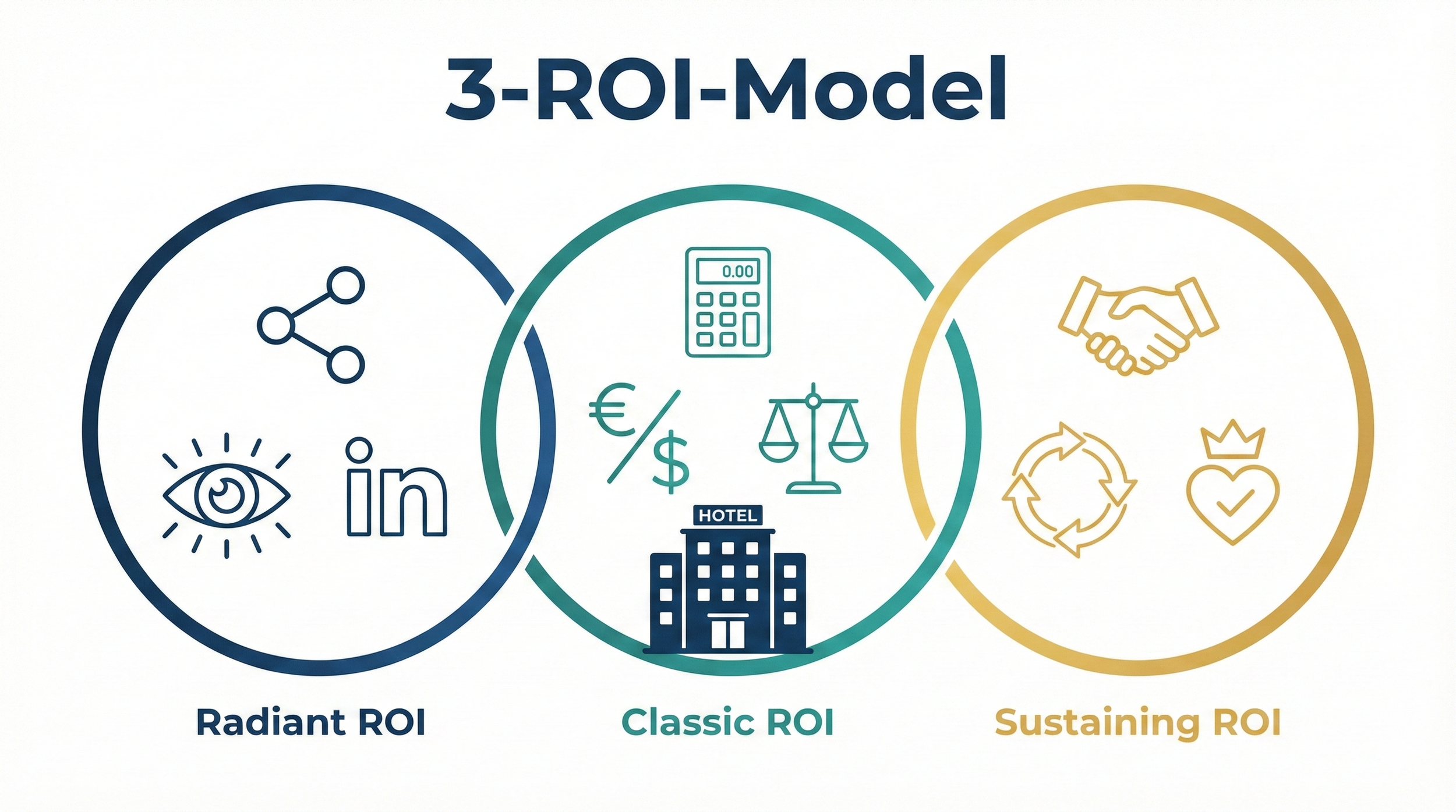

The three-stage ROI model considers several aspects of success and is therefore more appropriate for the complex MICE business than the classic ROI.

For many hotels, the return on investment in group and event business is a black box. While clear metrics such as RevPAR make success measurable in the accommodation sector, convention sales often remain limited to revenue figures. The problem: if you only measure revenue, you overlook the silent margin killers such as attrition (unused room allotments), planning errors in group requests, or missed cross-selling opportunities.

Jan von Schaper, Director of the DEKRA Congress Center, knows this challenge from his daily work. His experience shows that ROI in the MICE business is more than just a formula. It is a combination of hard numbers, relationship building, and strategic visibility.

Jan von Schaper is Head of Business Development Management and Head of Sales/Marketing at the DEKRA Congress Center Wart.

With over 35 years of experience in the hotel industry and MICE, he is one of the industry's leading voices. His focus: sustainable event concepts, value-oriented hospitality culture, and the strategic positioning of independent conference hotels in the digital market environment. As a member of the HSMA expert group, he provides forward-looking impetus for the MICE ecosystem.

Why ROI is so difficult to grasp in the MICE business

The classic ROI calculation sounds simple: net profit divided by investment, multiplied by 100. But in the event sector, this formula fails in reality. How do you allocate revenue to an event if self-payers and group invoices are not clearly separated in the system? How do you calculate the contribution margin if F&B services for buffets and self-service stations cannot be allocated to individual events on a cost-based basis?

Jan von Schaper sums it up:

"In contrast to ROI in the accommodation sector, I find that there are many vague figures in the MICE sector. The effort involved in ensuring attention to detail is very high and not always precise."

This lack of clarity means that many hotels stick to rough estimates: F&B sales, room rental, technology. Long-term effects such as customer loyalty or recommendations are assessed qualitatively rather than monetized. The result: decisions are based on experience and gut feeling rather than reliable data.

The Three ROI Model: A Practical Approach

Instead of viewing ROI as a single metric, Jan von Schaper suggests a more nuanced approach that does justice to the complexity of the MICE business.

The impressive ROI measures how an event strengthens the brand and creates visibility. LinkedIn mentions, meta posts with the hotel as the venue, occasionally a press release from an association. This ROI contributes to SEO and GEO, making the hotel better known among guests, event agencies, and companies.

The classic ROI is the familiar comparison of net revenue and net costs. This raises operational questions: energy, rent, and personnel costs per day are calculable. Material costs in the F&B sector are more difficult. Purchases made for one event but also used for subsequent events become blurred in the allocation.

The fundamental ROI captures the relationship level: How satisfied is the guest? How often do they book again? What cross-selling opportunities arise? Is the event a platform for recommendations?

"Experience does not replace key figures; it helps to interpret the right key figures."

Jan von Schaper proposes a three-stage ROI model for measuring MICE business.

The biggest levers: Why individual analysis doesn't work

Price, process, capacity, demand mix: these four levers are often considered in isolation. However, practice shows that their interaction is crucial.

An example: If the capacity analysis shows free rooms during known low periods, a high price is not the right lever. It prevents bookings instead of enabling them. At the same time, a high price can reduce recommendations if expectations are not met.

"A flat process structure is always a prerequisite for the successful implementation of strategies," says Jan von Schaper.

What does that mean in concrete terms? Process optimization and automation reduce errors and process costs, enabling faster quotes for group inquiries. Dynamic pricing can increase RevPAR by 12 to 18 percent, but also influences cancellation rates. Optimal use of square footage and participant numbers maximizes RevPASM (Revenue per Available Square Meter), but is often neglected.

Cancellations and wash-downs: the underestimated margin killers

The difference between the planned and actual number of guests or rooms can mean a 15 to 20 percent loss in revenue. Hotels that do not track this metric have a blind spot in their ROI analysis.

The good news is that with the right strategy, the loss can be minimized. Jan von Schaper reports from practical experience:

"With appropriate cancellation fee structures based on reasonable, mutually agreed terms, the loss in revenue can be recouped to within a few percent."

The key lies in two elements: First, transparent and fair cancellation policies that protect both sides. Second, an offering and occupancy strategy that factors in calculated losses once a certain number of guests has been reached.

ROI as a corporate task: Who needs to understand it?

Understanding ROI should not be limited to revenue management. Jan von Schaper is clear on this point: "Everyone in our company, from the kitchen to the director."

The reasoning: cost efficiency must be combined with a key account management mindset that brings expertise to the table and understands how events also have an emotional impact. Only when all departments understand the economic context can silos be broken down and cross-functional strategies implemented.

General managers, revenue managers, sales directors, and event sales managers must be able to evaluate deals not only in terms of revenue, but also in terms of added value. This means focusing on net profit, lead generation, and customer lifetime value rather than pure volume.

From experience to data-driven convention sales automation

Convention sales teams thrive on experience. But today, that experience can be measured. MICE DESK has developed Rocket, a hotel MICE software that analyzes historical data from the sales process: inquiry history, response times, conversion rates, cancellation patterns, price sensitivity, and customer development.

This results in concrete recommendations: Which leads are likely to be profitable and recurring? What should communication look like in terms of timing, tone, and argumentation? Which room combinations maximize revenue and utilization? Automated quote generation significantly reduces response time.

Tigran Manvelyan, CTO and co-founder of MICE DESK, describes the approach:

"We are not building Rocket as an AI gimmick, but as a scientifically based decision-making system. We test hypotheses with data, measure effects, and bring this thinking to the hospitality industry so that convention sales teams can make better decisions based on data rather than just gut instinct."

The principle: human-in-the-loop. AI suggests options based on historical data. The team makes decisions and provides feedback that improves the models. Human expertise remains central, but is calibrated by data. Gut feeling and experience become a measurable, scalable asset.

Scenario simulations show what happens with different parameters before a decision is made: What does a 10 percent price increase mean? How do stricter attrition clauses affect the business? What is the optimal ratio of group to transient business?

The next step towards measurable hotel profitability

ROI in the MICE sector is not a one-off project, but rather a continuous process. The first step is to create transparency regarding your own data. Which key figures are already being recorded? Where are the blind spots in convention sales?

MICE DESK Rocket helps hotels turn fragmented data into a coherent picture. Not as a substitute for experience, but as a tool that makes experience measurable and scalable.

Key takeaways:

ROI in the MICE sector has three dimensions: the radiant ROI (visibility), the classic ROI (revenue vs. costs), and the supporting ROI (relationship and repeat bookings). Only by considering all three can you get a complete picture of hotel profitability.

Cancellations and wash-downs are calculable risks: with cooperative cancellation policies and an occupancy strategy that factors in losses, revenue shortfalls can be reduced to a few percent.

The levers work in tandem: optimizing price, process optimization, capacity, and demand mix in isolation rarely leads to the desired result. The context determines which lever takes effect and when.

Understanding ROI is not a staff function: from the kitchen to management, everyone needs to understand how events and group inquiries impact the bottom line in order to break down silos.

Convention Sales Automation calibrates experience: AI-supported systems such as Rocket turn implicit knowledge into measurable decision-making bases without replacing human expertise.